Key takeaways:

- Your Amazon fulfillment costs depend on your product’s type, size, and weight, plus how you get it to customers.

- Amazon’s Brand Registry protects your brand and gives access to exclusive promotional tools.

- Avoid Amazon fees on small orders by selling on your own eCommerce site, but use Multi-Channel Fulfillment (MCF) for efficiency with larger sales.

Amazon is a massive marketplace with over 2.8 billion users, and it’s also America’s most trusted brand, making it a top choice for side hustlers and entrepreneurs alike.

Beyond its popularity, the platform offers strong earning potential. In 2024 alone, more than 55,000 independent sellers generated over $1 million in sales.

But to earn money, you often need to spend money, and selling on Amazon is no exception. Without preparation, what looks like profit can quickly turn into a costly mistake.

This guide will walk you through the real costs of selling on Amazon, from account fees and commissions to fulfillment expenses and hidden charges. By the end, you’ll have a clear picture of your potential profits and what it takes to succeed.

How much does it cost to sell on Amazon overall?

For a new seller moving about 100 items, your costs can range between $1,200 – $6,500, granted that you’re selling small to medium sized items. Of course, this could go up or down depending on the type of item you’re selling too.

Here’s a quick glance at what you’d be paying for:

| Fee Type | Estimated Costs |

| Professional account fee | $39.99 |

| Listing Costs (UPC codes) | $30 – $300 |

| Shipping to Amazon | $30 – $100 |

| Referral fees | $150 – $2,500 |

| FBA fees | $300 – $1,000 |

| FBA monthly storage fees | $25 – $75 |

| Refunds and returns | $100 – $400 |

| Advertising | $100 – $500 |

Just a quick reminder: these are just a snapshot of what’s possible, not a final quote. This doesn’t account for losses from returns, the costs of shipping items to Amazon warehouses, or other outside costs like taxes and packaging.

It might seem like a lot to take in, but don’t worry. We’ll walk you through each fee, what it covers, and when it’s charged in the sections that follow.

Amazon seller account fees

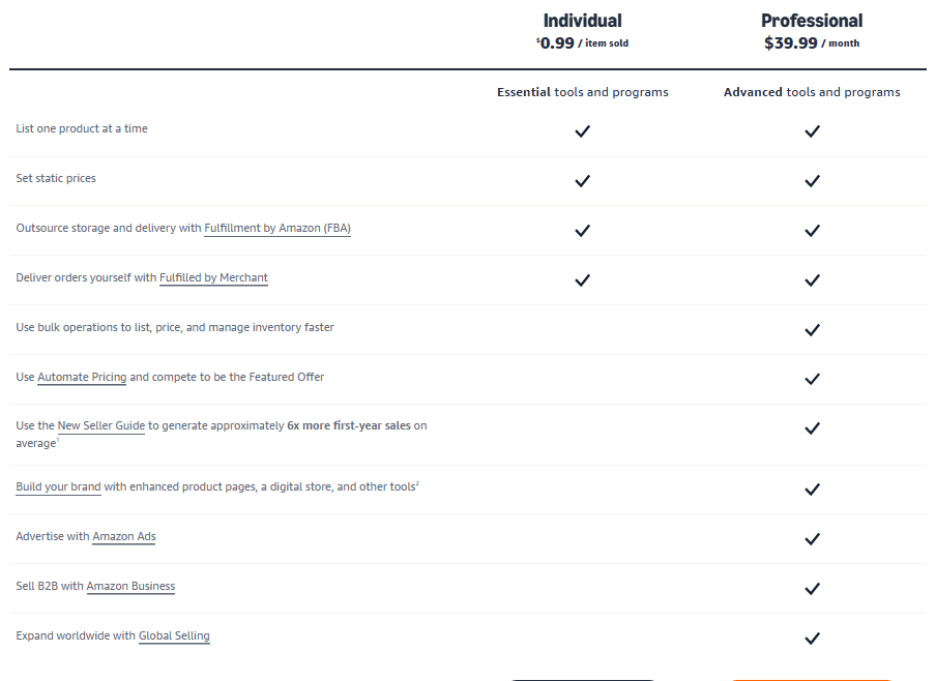

The first thing you have to pay for when applying to become a seller on Amazon is your account fee. Consider this as your charge for listing your products. There are two types of accounts to choose from: Individual selling plan and Professional selling plan.

Individual selling plan

This plan costs $0.99 for each item sold. It is an excellent option if you are just starting or only plan to sell a few items a month. This plan gives you access to the basics, including the option to use Amazon’s fulfillment services (FBA), but it has some limitations.

Professional selling plan

The professional selling plan comes at $39.99 per month and is ideal for those selling over 40 items per month. It includes all the basic features plus a number of advanced selling tools to help you manage and grow your business. These advanced features include:

- Using bulk operations to list, price, and manage inventory faster

- Using Automate Pricing to compete for the Featured Offer

- Building your brand with enhanced product pages, a digital store, and other tools

- Advertising with Amazon Ads

- Selling B2B with Amazon Business

- Expanding worldwide with Global Selling

- Selling with apps and APIs

Unique product codes (UPCs)

While Amazon doesn’t charge for product listings, you’ll need to provide a UPC code for every product variation you sell. For name-brand items, simply use the barcode already on the packaging.

To get a UPC code for your own products, go directly to GS1. You can purchase a single GTIN for a one-off item, which costs around $30.

If you’re building a brand, register your product line under GS1’s Company Prefix program to get a unique company code attached to each item and generate all the codes you need in bulk- at a discount.

The prices for a company prefix are:

- $250 for up to 10 products

- $750 for up to 100 products

- $2500 for up to 1000 products

- $6500 for up to 10,000 products

- $10,500 for up to 100,000 products

If you’re selling unique personalized products like engraved jewelry or laser-printed, made-to-order shirts, you can file for a GTIN exemption to list them without a UPC code.

However, if you are producing products under your own brand, even if they are not yet recognized, you must trademark your brand and register it with Amazon’s Brand Registry to list your products.

Referral fees

Amazon doesn’t charge you for creating a listing, but they do charge a commission, or referral fee, for every item you sell. For most products, this fee is between 8% and 15% of the item’s total cost, with a minimum charge of $0.30 per item.

Some product categories have much higher rates. For example, Amazon Device Accessories has a 45% referral fee. High-volume categories like baby products and beauty items also have tiered fees, where the percentage changes depending on the cost of the item.

Here’s a list of some of the most common product categories and their referral fees:

| Category | Referral Fee (percentage of the sales price) |

| Amazon Device Accessories | 45% |

| Baby Products | 8% for items with a sales price of $10.00 or less. 15% for items over $10.00 |

| Clothing and Accessories | 5% for items $15.00 or less. 10% for items $15.01-$20.00. 17% for items over $20.00 |

| Computers | 8% |

| Home and Kitchen | 15% |

| Jewelry | 20% for the portion up to $250.00. 5% for any portion over $250.00 |

| Toys and Games | 15% |

| Beauty | 8% for the portion up to $10.00. 15% for any portion over $10.00 |

| Health & Personal Care | 8% for the portion up to $10.00. 15% for any portion over $10.00 |

| Electronics | 8% |

| Pet Products | 15% |

| Books | 15% |

| Sports & Outdoors | 15% |

Refund administration fees

When you refund a customer, Amazon will reimburse the referral fee from that sale. However, they still charge a refund administration fee amounting to less than 20% of the referral fee or a maximum of $5.00 per item.

Amazon’s fulfillment types and fees

After choosing your Amazon seller account, the next big decision you make is determining your fulfillment type. Amazon give’s you three options to choose from:

- Fulfillment by Amazon (FBA). Amazon stores your inventory, handles all packing, shipping, customer service, and returns; this makes your products eligible for the Prime badge.

- Fulfilled by Merchant (FBM). You are responsible for all storage, shipping, customer service, and returns, which gives you maximum control over the process and costs.

- Multi-Channel Fulfillment (MCF). This is a service where Amazon fulfills orders for sales made on other channels, like your own website or other marketplaces, using the inventory stored in Amazon’s warehouses.

You’ll be glad to know you’re not locked into just one fulfillment type. Amazon actually treats your shipment types on a by-order basis, which is great for flexibility.

We’ll be covering the costs of each fulfillment method, and other associated costs, in the sections that follow.

Fulfilled by Merchant (FBM)

With FBM, you’re in complete control of your inventory and shipping. This means you are responsible for storing your products and getting them to the customer after a sale. You can manage this process yourself or partner with a 3PL.

If you choose to ship through FBM, you’ll still need to account for your payments to Amazon, which include:

- Seller account fees

- Referral fees

- Refund administration fees

- Advertising fees (if you choose to run ad campaigns)

- Closing fees for products in the media categories like books and DVDs.

While FBM sellers skip most of the fees associated with Amazon’s FBA program, by default they can’t boast the Amazon delivery guarantee or “Prime” badge in their listings, which buyers check when purchasing items on Amazon.

Amazon programs for FBM sellers

Amazon awards FBM sellers that meet Amazon standards for shipping and cancellation by making them eligible for the Premium Shipping or Seller Fulfilled Prime (SFP) programs.

The enrollment itself is free and there are no added seller costs. However, it can be very expensive to meet the expedited shipping requirement of 2 days or less for new sellers. Once the seller passed this requirement, they’re required to maintain their performance.

Fulfillment by Amazon (FBA)

FBA is when Amazon handles the fulfillment process for sellers. This is a per-unit cost that covers the picking, packing, shipping, and handling of your orders, as well as customer service and returns. The fees are based on your product’s type, value, weight, and dimensions.

The table below provides an overview of Amazon’s shipping costs per item. Note that for large bulky and all extra-large items, the fees are the same for both non-apparel and apparel products.

| Size | Non-apparel | Apparel |

| Small standard | $3.06 – $3.65 | $3.27 – $3.98 |

| Large standard | $3.68 – $6.92 + ($0.08 per 4 oz interval above first 3lb) | $4.25 – $6.92 + ($0.16 per half-lb above first 3 lb) |

| Large bulky | $9.61 + $0.38/lb interval above first lb | $9.61 + $0.38/lb interval above first lb |

| Extra-large (0 to 50 lb) | $26.33 + ($0.38/lb interval above first lb) | $26.33 + ($0.38/lb interval above first lb) |

| Extra-large (50+ to 70 lb) | $40.12 + ($0.75/lb interval above 51 lb) | $40.12 + ($0.75/lb interval above 51 lb) |

| Extra-large (70+ to 150 lb) | $54.81 + ($0.75/lb interval above 71 lb) | $54.81 + ($0.75/lb interval above 71 lb) |

| Extra-large (150+ lb) | $194.95 + ($0.19/lb interval above 151 lb) | $194.95 + ($0.19/lb interval above 151 lb) |

Amazon also offers a low-price FBA program for items under $10. Both apparel and non-apparel items that are considered small standard, large standard, and large bulky qualify for a $0.77 discount.

Extra-large items, even if they are priced under $10, are not eligible for this program and will be charged standard fulfillment rates.

Unplanned service fee

An additional cost in fulfillment which you should be wary of are “unplanned fees.” These are what FBA sellers pay Amazon for products that aren’t properly packaged or whose barcodes are missing or not scannable.

Amazon charges $0.55 per unit for missing and unscannable barcodes. Meanwhile, Amazon charges a fee of $0.70 to $2.55 per unit for items that do not meet their proper packaging guidelines. This also depends on the service and size needed.

Storage fees for FBA sellers

Amazon calculates its storage fees based on three key factors: the season, the product type, and its size. Here are the approximate base monthly rates per cubic foot for your general, non-dangerous goods:

| Product size tier | January – September (Off-Peak) | October – December (Peak) |

| Standard-size | $0.78 per cubic foot | $2.40 per cubic foot |

| Oversized | $0.56 per cubic foot | $1.40 per cubic foot |

You might notice that oversized products cost less per cubic foot. This isn’t meant to encourage selling huge items. It’s because these products naturally occupy significantly more space to begin.

For example, a seller might store 10 small stuffed toys that collectively take up 2 to 3 cubic feet. In contrast, a single large, life-sized stuffed toy could easily take up 10 cubic feet or more on its own, meaning the seller pays for a larger volume regardless of the lower per-cubic-foot rate.

Storage for dangerous goods

Amazon also charges more for dangerous goods like batteries, aerosol sprays, and some household cleaners, because they require special handling and storage safety requirements.

| Product size tier | January – September (Off-Peak) | October – December (Peak) |

| Standard-size | $0.99 per cubic foot | $3.63 per cubic foot |

| Oversized | $0.78 per cubic foot | $2.43 per cubic foot |

Returns and refunds

When you use FBA, Amazon handles the returns for you. The costs and reimbursements depend on who is at fault.

- If Amazon is at fault. If the item is damaged or lost by Amazon or its shipping carrier, Amazon will pay you back. They will give you a refund for the item’s value and some of the fees you paid.

- If the buyer is at fault. If a customer returns an item because they changed their mind or they damaged it, you are responsible for the costs. Amazon does not refund the referral and fulfillment fees you paid on the original sale.

Once the item is returned to Amazon’s warehouse it undergoes a return evaluation. If the item isn’t damaged and deemed as good as new, Amazon tags it as “resalable” and places it back in your inventory. Amazon will not refund the already paid FBA fees for the initial sale.

However, if an item can no longer be sold, Amazon tags it as “unsellable.” In this case, you have a few options:

- Removal and Disposal fees. You can pay a fee to have the item shipped back to you or have Amazon throw it away.

- Standard-size items. The fee ranges from $1.04 to $2.89 per unit, plus an additional $1.06 per pound above 2 lb.

- Large, bulky, extra-large, and special handling items. The fee ranges from $3.12 to $14.32 per unit, plus an additional $1.06 per pound above 10 lb.

- Resell it. You can choose to sell the item at a discount through Amazon’s Grade and Resell or FBA Liquidations programs. This helps you get at least some money back for the item instead of losing it completely.

Return processing fee

Amazon implemented this process in June 2024 to support the platform’s goals of minimizing returns.

Amazon sets a maximum return threshold for each category, with most products falling within the 9-11% range. However, some categories, like groceries, have a much lower threshold of around 2.9%. The fee is a per-item charge, which means it can get very expensive.

Here’s how it works:

Let’s say you sell watches. Amazon’s threshold for this category is 12%, so for every 1,000 watches sold, the threshold is 120 returns. For every return after that, Amazon starts charging the processing fee. The returns processing fee starts at $1.78 and could increase depending on the item’s size and weight. It can easily go beyond $150 for very large and heavy items.

Multi-Channel Fulfillment (MCF)

MCF lets FBA sellers use Amazon’s logistics network to handle inventory and shipping for all other sales channels, such as a personal website, Walmart, Etsy, eBay and social stores.

By storing all your products in Amazon’s fulfillment centers, they will manage the entire process of storing, picking, packing, and shipping orders to your customers.

Here are the costs for using Amazon’s MCF program:

| Size | 1 Unit | 2 Units | 3 Units | 4+ Units |

| Small standard | $6.99 – $8.25 | $4.81 – $5.70 | $4.10 – $4.88 | $3.64 – $4.38 |

| Large standard (3 to 20 lbs) | $11.34 + $0.68/lb above 3 lbs | $7.85 + $0.63/lb above 3 lbs | $6.79 + $0.63/lb above 3 lbs | $5.95 + $0.63/lb above 3 lbs |

| Large bulky (up to 30 lbs) | $17.55 + $0.73/lb above 2 lbs | $12.93 + $0.68/lb above 2 lbs | $11.16 + $0.68/lb above 2 lbs | $9.45 + $0.68/lb above 2 lbs |

MCF also covers large bulky items above 30 lbs to heavier XL items. However, unlike smaller items, these are fixed at a single unit rate.

In addition to the standard fulfillment fees, MCF sellers may also encounter surcharges in special circumstances. These include:

- Remote area surcharge

- Amazon logistics block surcharge

Remote area surcharge

Any orders shipped to Alaska, Hawaii, Guam, Puerto Rico, or the U.S. Virgin Islands will include a remote area surcharge. This charge is applied to the fulfillment fee and is 100% for standard-size items and 200% for large bulky and extra-large items.

Amazon logistics block surcharge

Some stores, like eBay and Walmart, prohibit sellers from promoting other brands. To sell items from these platforms in plain packaging, MCF sellers need to pay a 5% surcharge of their fulfillment costs.

So, if an item’s MCF fulfillment rate is $5, a seller needs to pay $5 + $0.25 (the surcharge) = $5.25 to have the Prime label removed.

Amazon currency converter for sellers (ACCS)

Apart from shipping fees and taxes, Amazon’s global sellers must consider currency conversion costs. Amazon has its own currency converter, the ACCS. Sellers can enable this service, which will then automatically convert their earnings for them.

It’s a fast and secure process but is also costly. The charges are made on a by-volume rate of 0.75% to 1.5% based on what the seller made.

Here is the breakdown of the volume-based pricing:

| Cross-currency net proceeds (USD) | Volume-based pricing |

| Less than $100,000 | 1.50% |

| $100,000 – $500,000 | 1.50% |

| $500,000 – $1,000,000 | 1.25% |

| $1,000,000 – $10,000,000 | 1.00% |

| $10 million+ | 0.75% |

The volume tier you fall into is determined by the global sales you make in 12 months. Note that Amazon has different platforms for each country, and you’ll need to link them under one seller account to unify your volume sale.

Specialized Amazon fees

When you’re selling on Amazon, you have more to pay beyond the standard fees: there are also several more specialized fees that only apply in certain situations, depending on what you’re selling or how you’re managing your listings. It’s smart to be aware of these.

Here are some of the most common specialized fees:

- Amazon closing fees. This is a fixed $1.80 fee charged per unit on items sold in media categories, such as books, music, and DVDs.

- High-volume listing fees. If you have over 100,000 active, non-media listings that haven’t sold in 12 months, you will be charged a monthly fee of $0.005 per eligible listing.

- Rental book service fee. This is a fixed $5.00 fee per unit on all textbook rentals, charged in addition to the standard referral fees.

- Lithium battery fee. For any product that is a lithium battery or contains one, Amazon adds a $0.11 fee per unit. This covers the special handling required for these items.

- Dangerous goods (Hazmat) fees. Products classified as dangerous goods (flammable, corrosive, etc.) incur higher FBA fulfillment and storage fees due to the unique handling and regulatory requirements.

Amazon ads

Amazon Ads are an optional addition to a seller’s costs, but they can be a powerful tool. While the platform operates on a bidding system where your ad might not always show, a strategic approach can lead to a strong return on investment (ROI). In fact, a recent Amazon report indicated that for U.S.-based small businesses, 36% of their sales were attributed to Amazon’s advertising solutions.

The costs are very flexible and depend entirely on your budget. For new sellers, a good place to start is with a monthly budget in the range of $50 to $3,000. The key is to begin with an amount you’re comfortable with and then scale your spending as you see what works best.

Strategic account services

This is an invite-only program for high-income sellers who need help managing a massive number of listings and sales. Costs start at $1,600 and can go as high as $5,000 per month, plus 0.3% of a seller’s sales from the previous month.

While pricey, this additional cost provides a dedicated Amazon account manager who acts as a trusted advisor to help with strategy, operations, and issue resolution. This service gives sellers an insider’s edge to help them navigate the complexities of managing a large-scale business on the platform.

How to reduce Amazon seller fees

While Amazon’s fees are a necessary cost of doing business, they don’t have to be a mystery. Understanding the fee structure and implementing a few key strategies can minimize your costs, boost your profits, and gain a competitive edge.

Here are some of the most effective ways to lower your Amazon seller fees:

- Do your own market research

- Register under Amazon’s Brand Registry program

- Create your own eCommerce website

Do your own market research

Avoid the costs of storing and promoting unprofitable products by doing thorough market research. Many Amazon sellers use Helium 10 and Jungle Scout for this. These are platforms known for their ability to analyze product data, perform keyword searches, and gain insights into a product’s potential for success.

Register under Amazon’s Brand Registry program

Brand Registry is a free program that helps you create a brand identity and provides access to valuable tools and incentives. Sellers that register can get to enjoy the following perks:

- Create a custom storefront and A+ Content. This builds a unique brand identity, enhances your product listings with rich media, and improves your conversion rates.

- Get a Brand Referral Bonus. You can earn a bonus of 10% back on your first $50,000 in branded sales, and then 5% back through your first year until you reach $1,000,000. These bonuses are applied as credits to your referral fees.

- Access to Amazon’s Creator Connections. This program allows you to partner directly with Amazon Creators and influencers. It is a pay-for-performance model that gives you a more strategic way to promote products than traditional ads.

Create your own eCommerce website

Building your own website is a strategic move for any serious seller. This won’t directly reduce your Amazon fees, but it lessens the burden of competing on their platform and gives you a powerful asset.

Selling on your own site also gives you better branding opportunities and full control over your profits, unless you use Amazon’s MCF service.

Go beyond Amazon

Now that you have a clear picture of what it costs to sell on Amazon, you’re ready to move forward with confidence. Use this guide as your reference point whenever you need clarity on fees and costs.

If you are looking to take the next step, whether that means creating something truly your own or building your brand beyond Amazon, we have you covered. Our AI-powered website builder and vast collection of templates make it easy to launch your eCommerce site quickly so you can start growing your online store on your own terms.

Frequently asked questions

The cost of selling on Amazon varies depending on what you sell and how you fulfill orders. Our estimate shows that shipping 100 items through FBA can cost anywhere from $1,200 to $6,500, though the final amount may be higher or lower depending on the product’s size and other factors.

Amazon referral fees are the commission Amazon takes from each sale. The percentage depends on the product category, but for most items it ranges from 8% to 15% of the total price.

If you’re on the Professional plan, you’ll pay the $39.99 monthly fee upfront, just like a subscription. All other fees, including referral fees and the Individual plan’s $0.99 per-item fee, are deducted directly from your sales before Amazon transfers the balance to your bank.

Definitely! While it may seem like a lot and understanding the FBA fee structure can be overwhelming, the benefits often outweigh the cost.

Shipping with the Amazon brand is a bonus, as FBA gives sellers access to millions of Prime customers, outsourced fulfillment (storage, packing, and shipping), and automatic handling of customer service. These advantages are especially great for high-volume sellers looking to grow their business efficiently.

The best way to avoid long-term storage fees is to keep your inventory moving. Regularly review your stock levels, run promotions if needed, and use Amazon’s tools to identify items that aren’t selling quickly enough.

Yes, it’s possible. In fact, a study showed that around 40% of Amazon sellers earn between $1,000 and $25,000 in monthly revenue. Success depends on finding profitable products and managing your costs carefully.

It varies by category and fulfillment method. For example, with a 15% referral fee, Amazon would take $15 from a $100 sale. If you use FBA, you’ll also need to factor in shipping and handling fees, which depend on the product’s size and weight.